As Good An Excuse As Any

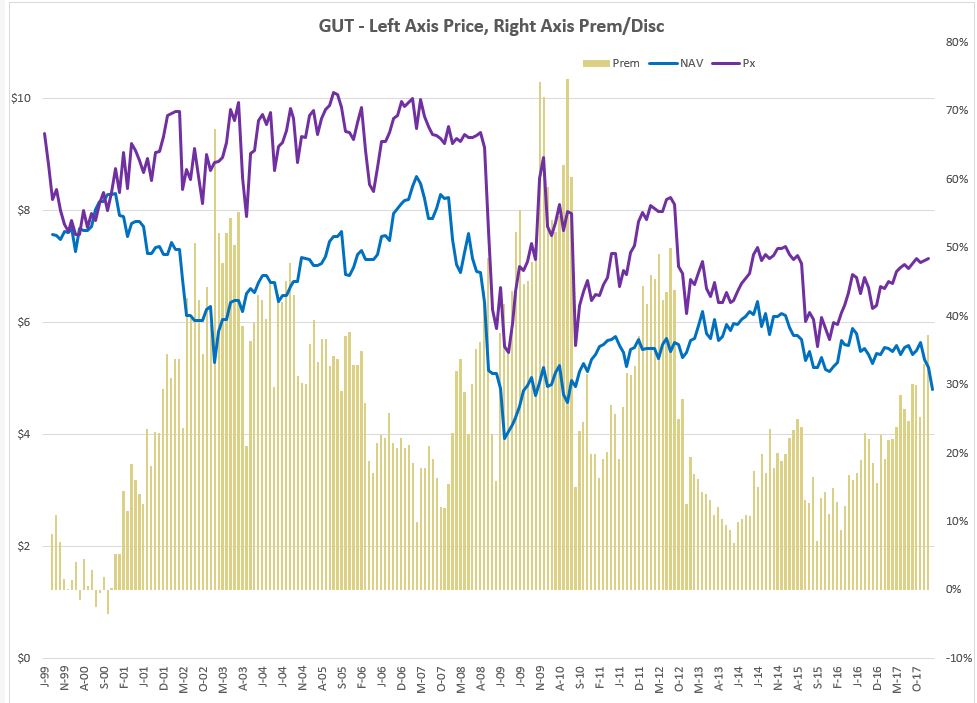

An excellent Planet Money on wildfires and who pays for the damage brought me back to GUT and then discussing utilities in general. GUT is currently king of the CEF premium rankings table at an eye popping 47% above NAV.

Use XGUTX - same format for most closed end funds with an X before and after the ticker - to pull up underlying asset value reported in the service of your choice.

Despite being more than double the 3 year average, it is not at it’s all time high for premium. Borrow is not exactly plentiful or cheap - no size and over 25% a year.

Note, this chart is monthly data, so a bit stale for pricing.

Three of the top four holders are also GAMCO, GAMCO spinoff AC, and Super Mario himself. That leaves me still net long Gabelli closed end funds as a whole which is just as well being a fan of the organization and Gabelli himself.

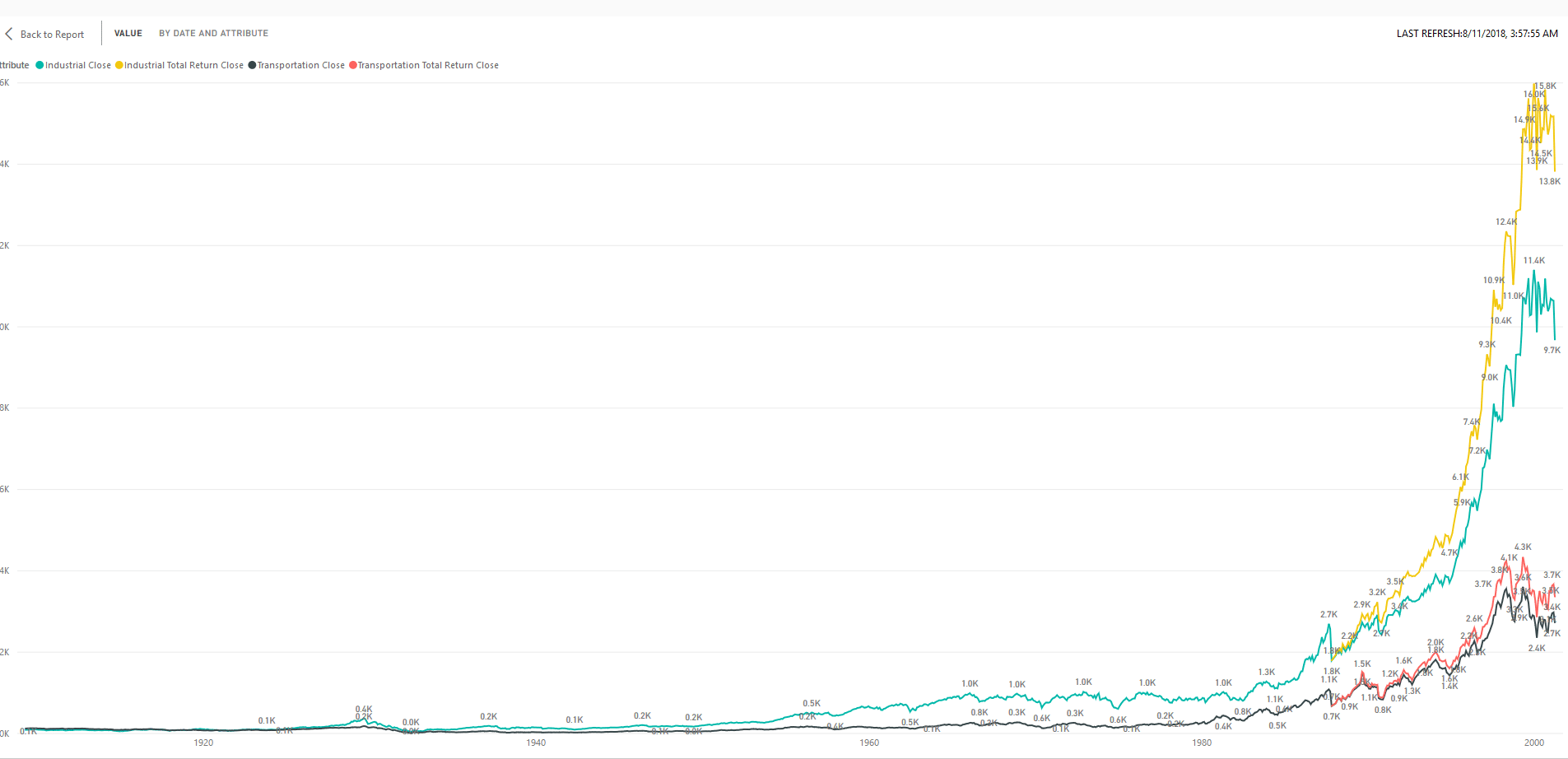

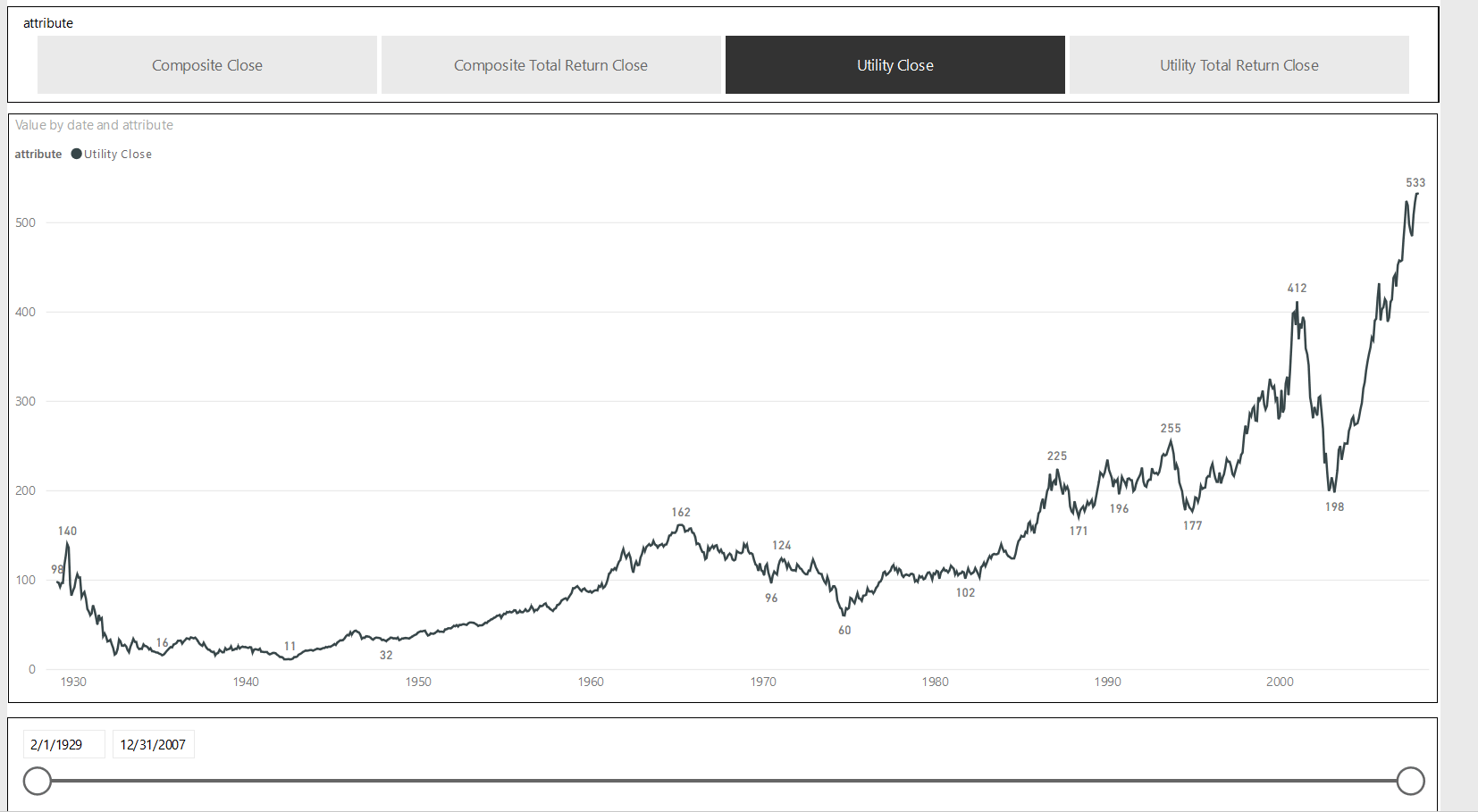

The conversation eventually turned to utilities and their yield as a “safety trade” which got me looking into some of the historical data from past downturns.

I had been looking for an excuse to explore some of the really long term stock price data sets I had seen and this was as good as any was going to get. You can find the result below.

I had a sense that it wasn’t great during the dot com days (Enron, etc) but I was still pretty surprised to see back to back 20+% losses in 01 and 02 on a total return basis. Still a walk in the park compared to 1929-1931, peak to trough down 85%! Not a fair comparison as the old data is price only and stocks paid a lot more back then, but still.